Content

An organization needs to identify and classify costs into various categories for cost optimization, reducing cost, and increasing production efficiency. The selling, general, and administrative expenses (SG&A) category includes all of the overhead costs of doing business. A method of accounting for supplies and expenses is required in order to identify the benefit of the supply or expense to the federal sponsored agreement. Clear justifications at the time of the charge and quarterly certification of expenses by the principal investigator are needed to meet this requirement. OMB Circular A-21 requires that routine administrative expenses be treated as Facilities and Administrative (F&A) or indirect costs unless certain circumstances, described in A-21, apply.

Administrative expenses are expenses not involved with producing or selling that a business incurs. Instead, they are costs of tasks a business needs to undertake to continue operations. In the context of insurance, insurance companies commonly have a number of administrative expenses, such as rent, utilities, certain salaries, and anything else not directly involved with underwriting or marketing. Administrative costs are an essential component of business operations. Regardless of its sales volume, it will always be present in the company. Businesses in various locations typically incur the exact administrative costs.

Company

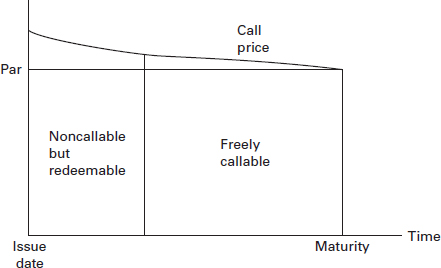

Administrative expenses are typically ongoing and not tied to a single, limited-purpose business function. Generally, insurance is included in the administrative expenses category. However, to be more specific, property insurance will be presented either as part of manufacturing overhead, selling, or administrative expenses.

Understanding what these expenses are is key to knowing how much money should be allocated towards them in order to keep the company running smoothly and efficiently. By keeping track of your general and administrative expenses you can ensure that you remain within your allocated budget while still being able to provide essential services. However, this outlook towards sales and profit generation also neglects several operating expenses. Indeed, these expenses may not directly be linked to the revenue generation for small businesses and companies.

Administrative Expenses in Practice

Submit prior approval requests to OSP for the direct charging of (ITS – Telecom Infrastructure Bundle) and (ITS FTE Billing – Internal Expense), as appropriate. Complete Form 1403 FR.02 documenting and justifying F&A type expenses on federal awards when prior approval is unnecessary. Under the Department Business Office guidance, complete Form 1403 FR.02 documenting and justifying F&A type expenses on federal awards when sponsor prior approval is unnecessary. §503,witness fees and mileage payable under28 U.S.C.A. §§1821are allowable as an administrative expense.

Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. Administrative overheads should, therefore, be charged to these two divisions. The manufacturing and selling divisions cannot function effectively without the help of the administrative function. Finally, you may be able to save money by relocating some or all of your operations. This could involve moving to a cheaper office space, hiring remote workers, or relocating your manufacturing or distribution center to a more cost-effective location.

How to Reduce General And Administrative Expenses

Consequently, as a normal course of business, these costs may no longer be included in proposal budgets to sponsoring agencies.This treatment of such costs allows for consistent recovery through the F&A rate mechanism. As required by federal regulations, costs incurred for the same purpose in like circumstances must be treated consistently as either a direct or an F&A cost. General and Administrative (G&A) expenses are the day-to-day costs a business must pay to operate, whether or not it manufactures products or generates revenue.

Administrative expenses are presented as part of operating expenses, which are deducted from gross profit or gross income to arrive at operating income before finance cost and taxes. Direct charging of administrative or clerical salaries to a non-federally sponsored project is appropriate if the services benefit the sponsored project. Some non-federal sponsors may have specific requirements for direct charging of administrative costs. Apart from predicting the salaries to be paid, technological upgrades, and office expenses, a few overhead costs are not included in the g&a expense budget. Obviously, the expenses mentioned above are usually classified as fixed costs.

Are SG&A Expenses Tax Deductible?

This section of the policy reflects OMB Circular A-21 which establishes the principle that administrative expenses should normally be treated as Facilities and Administrative (F&A) or indirect costs. This section also reflects the A-21 circumstances where it is appropriate to charge administrative expenses directly to sponsored agreements. Thus, the general and administrative expense for an organization contribute to indirect costs and operating expenses over a finance period. Lastly, these could be accounted for and predicted to increase the revenue by improving production capacity and enhancing the selling capabilities. In addition, there are overhead costs beyond the cost of goods sold that must be considered for a financial year. General and administrative expenses (G&A) are the day-to-day operating costs of running a business.

- A well-categorized income statement that includes administrative expenses is a central facet for any company to build a culture of compliance that reflects inward and to the investing public at large.

- In accounting, general and administrative expenses represent the necessary costs to maintain a company’s daily operations and administer its business, but these costs are not directly attributable to the production of goods and services.

- Deans’ office administrative activities must be consistently treated as F&A costs.

- For instance, a business or a company must procure products or stocks for selling them in the market.

- By cost behavior, most of these costs are fixed, though there are variable or mixed administrative expenses.

For these reasons, SG&A expenses should be compared with similar companies, if possible. In this case, the principle applied is that the administrative overheads have no direct relationship with the manufacturing or selling divisions. In this way, administrative overheads are absorbed in both manufacturing and selling and distribution overheads. An important characteristic of administrative overheads is that they are usually constant. They are not affected by changes in the volume of production, sales, or other factors.

The 2021 annual report shows Coca-Cola’s administrative, sales, and general expenses to be $12,144 million; in 2020, the expenditures amounted to $9,731 million. This rise results from an overall increase in annual incentives, charity, advertising campaigns, and stock-based compensation. Salaries and wages cost employees engaged in finance, accounts, human resources, information technology division, etc.

What is administrative expenses in IFRS?

Administrative expenses are expenses that cannot be directly tied to a specific function within the company such as manufacturing, production, or sales. G&A expenses include rent, utilities, insurance, legal fees, and certain salaries.

Businesses always require legal guidance and assistance for many reasons. From filing contracts to tackling tax cliche, companies need all-around advice from their legal team. Thus, legal advisory fees like lawyers, notary publics, and tax officers are the ongoing types of administrative expenses expenses for any company. Expenses are the by-products of anything you do in your business, whether generating sales or filing tax reports. And so do they deserve their category because not every expense is operating, and not every expense is recurring.

What are not administrative expenses?

Non-administrative expenses means custodian fees, issuance costs, and interest on Financing Corporation obligations.